Things are relatively quiet on the law change front at the moment as Parliament is adjourned for the school holidays until Tuesday, 4 May 2021.

Below is a summary of some key law changes since our newsletter in February 2021.

What laws have changed recently?

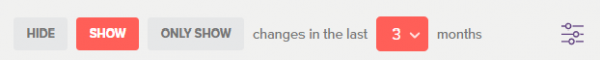

To find out more about the law changes that affect your organisation, log into your ComplyWith, hit the ‘Update your content’ button, and check out the new Clarity of Change enhancements to your Obligations Register.

Key changes for all sectors

- The Epidemic Preparedness (COVID-19) Notice 2020 was again extended and is now due to expire on 21 June 2021 (but can be revoked earlier or extended). Many temporary COVID-19 changes will end when this notice expires.

- On 31 March 2021, the Holidays Act was changed to allow employees to take up to 3 days' bereavement leave for miscarriage or still-birth.

- On 1 April 2021:

- The minimum wage increased from $18.90 to $20.00 an hour

- The student loan scheme repayment threshold increased from $20,020 to $20,280

- A new basic personal income tax rate of 39% for taxable income over $180,000 was added

- A new FBT rate of 63.93% was added for all-inclusive pay over $129,680.

- Entering contracts or arrangements that contain cartel provisions with the intention of price fixing, restricting output, or market allocating became a criminal offence under the Commerce Act on 8 April 2021. To understand more about cartel conduct there’s some helpful videos on the Commerce Commission’s website.

- A new hazard classification system for hazardous substances came into force on 30 April 2021. The new system is the Globally Harmonised System (GHS 7) and it replaces the 2001 HSNO classification system. Information about the change is on the EPA website.

- Changes to the Unclaimed Money Act came into force on 30 March 2021. The length of time for money to become unclaimed was changed to 5 years (previously 6 or up to 25 years depending on the money), and the reporting requirements were changed. More information is on the Inland Revenue website.

- The new financial advice regime came into force on 15 March 2021. Information on the new regime is on the FMA website.

Changes for the electricity industry

- On 1 April 2021:

- A new obligation was added to Part 13 of the Electricity Industry Participation Code requiring major participants, which includes ancillary service agents, to send a quarterly disclosure report to the Electricity Authority

- A new obligation was added to Part 11 requiring distributors to provide information about the dispute resolution scheme

- Changes were made to Electricity information exchange protocols (EIEPs) 1, 2, and 3 to make 'replacement RM normalised' the standard reporting methodology in EIEP1.

- On 6 April 2021, the definition of disclosure information under Part 13 of the Code was expanded to mean information that the participant expects (or ought reasonably to expect), if made available to the public, is likely to have a material impact on prices in the wholesale market (previously will have a material impact).

Changes for local authorities

- Changes to the Local Government (Rating) Act came into force on 13 April 2021. These included new provisions about writing off unpaid rates and considering applications to remit rates on Māori freehold land under development.

- The Local Electoral Act was changed on 2 March 2021 to remove provisions about binding polls on whether Māori wards or constituencies should be established.

Changes for tertiary education

- On 12 April 2021, the NZQA rules were reissued to align with the Education and Training Act 2020.

- The Domestic Tertiary Students Notice 2021 came into force on 21 April 2021 and replaced the Domestic Students (Tertiary Education) Notice 2019.

Changes for the health sector

- On 9 April 2021, the notifiable level of lead absorption in Schedule 2 of the Health Act was changed from 0.48 micromoles per litre to 0.24 micromoles per litre.

What’s coming up?

- Most provisions of the Animal Welfare (Care and Procedures) Amendment Regulations come into force on 9 May 2021.

- Early childhood centres must display notices forbidding vaping by 11 May 2021.

- The temporary COVID-19 exemption from the verification requirements for non-essential food businesses will be revoked on 22 May 2021.

- On 1 July 2021:

- Employees who provide certain types of security services will be covered by the protections in Part 6A of the Employment Relations Act (Continuity of employment if employees’ work affected by restructuring)

- The remaining provisions of the Local Government (Rating of Whenua Māori) Amendment Act 2021 come into force

- Some temporary COVID changes to the Local Government Act 2002, Freedom Camping Act, and Waste Minimisation Act will be repealed.